Payment Gateway is another tool of convenience invented for those who have shortage of time. It enables electronic transactions of money between customers, banks and businesses. This process is a must for all online businesses and shopping carts. Following are the features of a Payment Gateway:

Specialized fraud detection tools can be added to a payment gateway in order to ensure safety. Many web hosting companies provide payment gateways within their packages.

- Facilitates ecommerce operations, also it allows transactions in conventional brick and mortar businesses.

- Encryption of private data as well as payment.

- Carries out communique between the concerned financial institutions, the business and the customer.

- Authorization of payments.

- Feature to calculate the sales tax, handling costs and shipping rates is available only in some payment gateways.

Working of a Payment Gateway:

All the operations of Payment Gateway are carried out with the help of Internet. Many brick and mortar businesses also make use of them as they are quicker and more reliable means of payment.

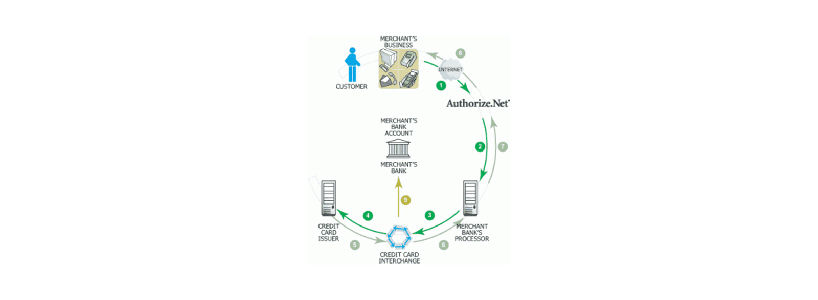

Following are the steps involved in the working of the payment gateway:

Thus Payment Gateway is a complicated process but is efficiently and swiftly carried out. Its incorporation in the business transactions has widened the scope of businesses. Also, it enables the businesses to conduct trade smoothly with clients all over the world.

- The customer buys a product or products through a Web site, phone order or in person.

- The SSL (Secure Socket Layer) coding is used by the customer's browser to "scramble" the data that is being sent.

- The information is collected by the business website and forwarded to the payment gateway.

- The information is then sent to the bank by the Payment Gateway.

- The request is then forwarded to the card association. If card used in the transaction is Discoverer or American Express, the association is then the same bank and if Visa Logo or MasterCard some extra steps are taken.

- In the case of Visa Logo or MasterCard, the information related to transaction is forwarded to the concerned bank (customer's bank).

- This bank checks whether the customer's account have sufficient balance or not.

- An authorization code is sent by the customer's bank to the card association informing them whether the transaction should be completed or not.

- The authorization code is then sent to the Payment Gateway.

Finally a code is sent to the business by the Payment Gateway. The refusal of the transaction leads to the termination of the sales deal. The approval helps forward the sale and the money is taken from the account of the customer.